Despite economic challenge faced by Nigeria, demand for the country’s art continues to boom. Nigerian art continues to gain global attention and command staggering fees on the domestic and international markets.

This development comes against the backdrop of an increasing representation of artists by professionally-run galleries specialising in art from the African continent; more appearances by Nigerian artists at major fairs, biennales and festivals, all over the world, more artists studying at prestigious international institutions; and critical text, well distributed to new audiences through alternative channels including social media.

On a daily basis, between 10.00am and 12.00pm, you’re sure to find nothing less than 20 artists at the DHL office with well packaged art works ready to be couriered abroad. It is a testament to the growing interest that African artists have spurred on the international markets.

Amid strong demand and skyrocketing prices, contemporary African art is increasingly attracting the attention of investors worldwide. At least half of the contemporary African art sales registered at auctions worldwide are believed to come from buyers within the continent, chiefly Nigeria and South Africa.

Experts also cite the strong growth of African economies and the rising wealth of the middle class as leading factors in the surge of interest around contemporary African art.

Taking advantage of the evolving art market in Nigeria, Vetiva Fund Managers Limited (VFML) has partnered with a Lagos-based advisory firm, GoudenFara, an intersection of art and finance, for the release of its maiden Pre-Auction Advisory Note designed to provide key insights into the individual market fundamentals of artists whose works are scheduled for sale on the international auction market.

The partnership with Vetiva Fund Managers, a leading investment management firm in Nigeria and subsidiary of Vetiva Capital Management Limited (VCML), seeks to catalyse further growth and development within the art industry in Nigeria and the African continent, in alignment with Vetiva’s vision of showcasing investment opportunities in the alternative assets space in Africa.

The landmark partnership will see both firms combine their expertise across the capital market and art economy. It will equally enable them to offer unique solutions to investors considering art in their alternative asset portfolio.

The chief executive officer (CEO) of GoudenFara, Ekiko Inyang, expressed optimism and confidence that the synergy of both firms would result in creating a solid entry point for financial market participation in the art market, thereby, ensuring adequate management of asset, financing structure, and holistic wealth reporting.

According to Inyang, the pioneering initiative has potential to bring the standard of equity market analysis into analysing art as an asset class, and also provides unparalleled market research and insight tailored for investors and collectors who are keen on integrating art into their alternative investment portfolio, as well as wealth managers who manage the account of clients looking to optimize their art holdings.

He said, “the pre-auction advisory note is also useful to art industry stakeholders such as gallerists, dealers, auctioneers, artists and art advisers, giving them access to crucial information about underlying factors driving the market.”

For the Managing Director, VFML, Mrs Oyelade Eigbe, the initiative places the concerns of investors at the forefront because, “I believe that art goes beyond canvas. Its role as a financial instrument in portfolios must be reimagined.”

She noted, “in an era of evolving investment landscapes, where traditional asset classes face challenges, and investors seek diversification and stability, fine art is emerging as contemporary contender. And beyond aesthetics and cultural significance, art is increasingly recognised as a viable financial assets and this partnership with a significant focus on research-backed analysis aims to shed light on why art deserves a place on balance sheets alongside stocks, bonds, and real estate.”

The VFML boss revealed that “fine art offers stability and resilience, holding value overtime with low volatility in terms of crisis, adding “it offers diversification potential as it has minimal correlation to traditional assets. And with fine art being a specialised area, Vetiva and GoudenFara’s teams look forward to providing expert guidance and research-driven insight in the journey of extending art’s value beyond galleries and museums.”

On the Pre-Auction Advisory Note, she said, “this comprehensive advisory note meticulously researched by GoudenFara’s team of analysts aims to uncover how the art market works and serves as a valuable resource for navigating its intricate paths.

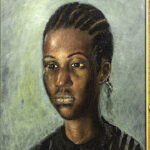

“In recognition of the growing interest in art as a financial asset, and component in alternative investments, GoudenFara’s analysis equips investors with strategic information to make informed decisions in the dynamic world of art and finance. So, this début edition of the advisory note provides market coverage for renowned Nigerian modernist artist Ben Enwonwu, whose 1982 oil example portrait of Tonkin Jackson is scheduled to go under the hammer in Modern and Contemporary African Art collecting category at Bonham on March 27 in its London Afternoon sale,” Eigbe said.