African leaders, yesterday, called for a fair global financing architecture, especially an indigenous credit rating agency, to truly assess the risk and strength of African economies.

The leaders, at the opening ceremony of the Annual General Meeting of the African Development Bank (AfDB) Group, in Nairobi, Kenya, said the vast potential of the continent and its transformation drive remain encumbered without a new multilateral economic order that offers good development financing and on fair terms.

Among the leaders that took charge were the presidents of Rwanda, Kenya, Congo DR, Zimbabwe, Somalia, Burundi, Namibia, Niger, Gabon, Guinea Bissau, Mozambique and Libya.

Conspicuously absent, however, was the Nigerian President, Bola Ahmed Tinubu, who was neither represented.

President of the AfDB, Dr Akinwumi Adesina, in setting the tone for the presidential dialogue on transformation of the global financial architecture noted that the system has a great role to play in mobilising resources for development.

However, the current architecture is not delivering enough for Africa in multiple areas, including climate financing that avails only $30 billion out of the $277 billion needed yearly to cushion the devastating effects of drought and flooding in several countries.

Also, the global financial system is not delivering the financial scale of $1.3 trillion needed for accelerated development to meet the Sustainable Development Goals (SDGs) by 20230, having failed to provide a buffer in the face of the last pandemic.

“No wonder there are economic divergences between Africa, developed and even emerging market economies. The global continent financing facilities have not been fair and equitable. Take the case of the Special Drawing Rights (SDR), out of the $650 billion of the SDR allocation, Africa got $33 billion, which is roughly 4.5 per cent. In other words, those that need it the most got the least,” he said.

Adesina added that the global financial system is also failing to deal with the debt burdens of African countries, “yet a more timely, comprehensive debt treatment, restructuring and resolution are urgently needed”.

“The rules of global taxation need to be modified to ensure that they are serving developing countries. Cooperation across jurisdiction tax rules is needed to avoid Africa losing taxes to multilateral corporations that do illicit capital flows. Therefore, we must make sure that the whole issue of profits, tax avoidance and profit base shifting are addressed. In my view, if you do business in Africa, you should pay taxes in Africa,” Adesina said.

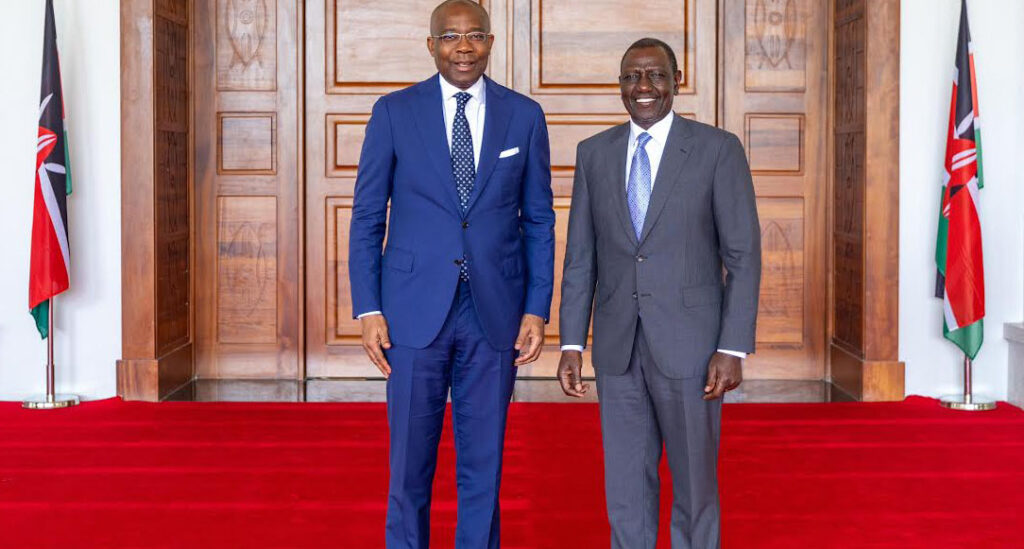

Apparently in agreement with Adesina, the host and President of Kenya, William Ruto, affirmed that Africa has what it takes to succeed, but the countries are faced with a stringent financing mechanism that levies up to eight or 10 per cent higher interest rate on Africa than in other parts of the world.

Ruto said an Africa that has a huge resource could not at the same time have a low Gross Domestic Product (GDP) compared with others without resources.

“I therefore believe that we need to change the narrative because we have been rated wrongly for so long. AfDB can support us to have an African credit rating agency that will factually rate African countries and our risks too.”

He added that the right financing architecture needed in Africa must be such that it offers long-term financing of about 40 years, low interest rates, concessional financing and possibly grants.

“We also need financing upscale that is agile and flexible, that is climate responsive when there are shocks. Finally, it must be sensitive, moving from potential to investment.

“We have been clear and consistent in our advocacy. Africa is neither seeking handouts nor asking for charity. We are a continent of sovereign people who aspire to grow in a just multilateral system and access development financing on fair terms. We were clear at the African Climate Summit last year when we called for reforms of international financial institutions and a range of new global taxes to fund climate action,” Ruto said.

Ruto’s counterpart in Rwanda, Paul Kagame, noted that the international financial architecture was framed in line with the interests of the “architects”, adding that Africa must also take care of its interests though with one voice and louder.

“The reform is that how do we disrupt the current framework? It must be based on our interests. How can anyone interested in the interest of the world sideline our continent? Soon, the only continent that will have a growing middle class will be Africa. So, it is in the interest of the world to see to the interest of Africa. If Africa grows the whole world grows. But Africans cannot be waiting on the borderline for handouts, we need to be more proactive in this cause,” Kagame said.